As we discussed in our previous article, StashAway Thailand offers a smart way to invest globally for both Thai and expat investors after they recently launched their digital wealth management platform in Thailand. There is growing interest in the building of diversified portfolios which feature exchange-traded funds (ETFs) and StashAway, South East Asia’s largest digital wealth manager, makes it easy to get started on your investment journey.

ETFs are popular as they are considered to be low-risk investments: the costs to buy and sell them are low and they hold a basket of stocks or other securities, helping to increase levels of diversification. StashAway’s systems astutely choose overseas ETFs that form your personalized portfolio, so you can invest easily, intelligently and cost-effectively.

Signing up for an account takes only 15 minutes, meaning you’ll soon be up and running to benefit from data-driven, risk-managed investing. Their investment framework, ERAA™ (Economic Regime-based Asset Allocation), chooses the best path to navigate through changing economic factors, so that your money is not exposed to unnecessary risk.

Sophisticated Investing, Globally Diversified Portfolios

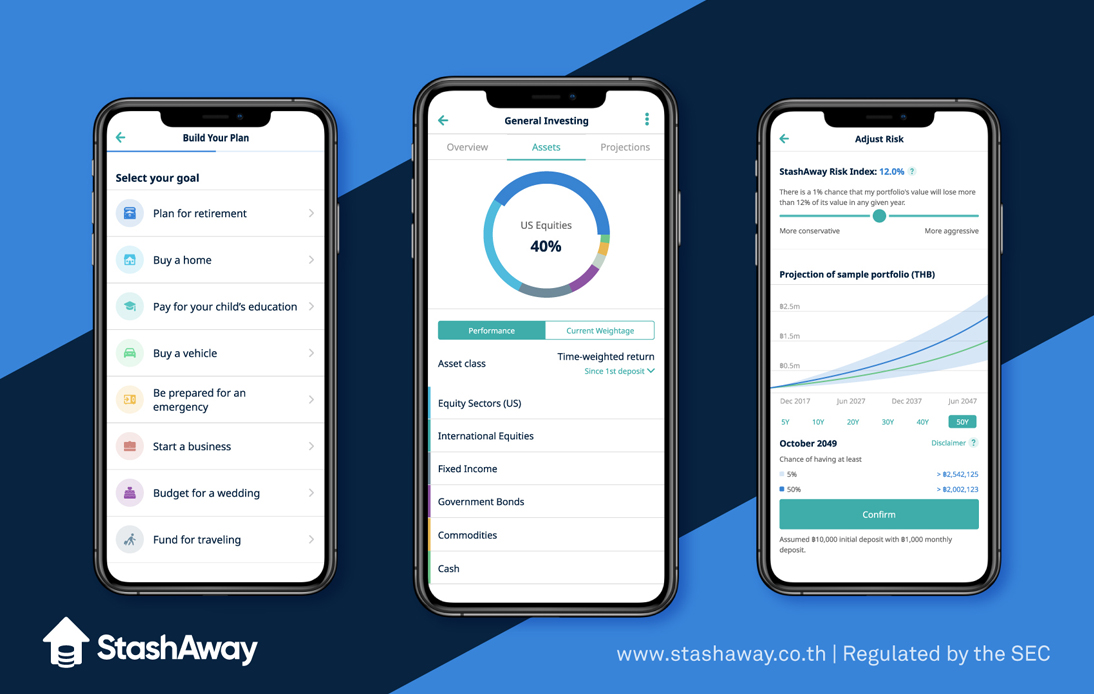

You may be investing to build your wealth, in which case, a StashAway General Investing Portfolio makes sense, where you do not have to know exactly what you wish to save for. Simply choose the risk level you’re comfortable with so that StashAway’s technology can then manage the risk based upon your personal preferences, helping you navigate your portfolio through economic changes that can have significant effect in the long term.

If you are keen to invest towards your life goals, then a StashAway Goal-Based Investing Portfolio is something that should be considered, giving you the best chance to have an achievable amount saved in time for a particular milestone. Your risk is managed based upon your chosen timeline, so all that’s left to decide are which goals to pursue: buying houses or cars, and planning for retirement, are among user’s most popular goals.

The StashAway Risk Index (SRI) makes risk management easier and more effective, with users having twelve different Risk Index levels to select from: portfolios are managed to ensure a 99% probability that they won’t lose their value by more than the selected SRI. So, if you have a THB 1,000,000 portfolio with an SRI of 10% then there’s a 99% chance that it will not be worth less than THB 900,000 in a year if you choose a 10% SRI.

StashAway’s personalised financial planning and digital wealth management of portfolios intelligently navigates macroeconomic data, instead of the ups and downs of the market. The sophisticated ERAA™ investment model works by simply enhancing Modern Portfolio Theory (MPT, a Nobel Prize-winning theory), while addressing external economic forces, which ultimately drive the returns, volatility, and correlations of different asset classes.

Traditionally, most portfolio management has been based on MPT fundamentals to mainly focus on risk and returns, believing that an efficient portfolio is one that invests in multiple asset classes to achieve better long-term average returns over concentrated investments. StashAway elevates the efficient portfolio criteria to take into consideration the impact of changing economic conditions, investing wisely for their customers to benefit from.

ERAA™ has three pillars, Economic Regimes Determine Asset Allocation, Risk Shield, and Valuation Gaps, which comprise their macroeconomic portfolio management strategy to minimise risk and maximise returns with the key objective of making informed decisions by analysing high-quality economic data to determine how best to allocate assets.

How StashAway Makes It Possible To Charge Low Fees

StashAway have devised investment strategies and developed technologies that reduce their operational costs, in turn passing those savings on to customers who have invested with them. Greater returns are possible over the long term by taking advantage of lower fees, as traditional products can significantly eat into your compound interest earnings.

The fees that StashAway charge vary between 0.2% and 0.8% annually, which are highly competitive when compared to the management fees of traditional investment products, typically charged at between 1.25% and 3% annually of the total assets in a portfolio. The low fees are due to StashAway’s leveraging of efficient, automated technology, investing in low-cost ETFs, and from operating with a passive approach to investment.

For further information on StashAway Thailand, you may visit: https://bit.ly/31UEFlN with the apps available at: Apple App Store or Google Play Store to download.