StashAway is the digital wealth management platform that was founded and launched in Singapore back in 2017, before going on to expand in other countries including Thailand. Through their investing technology, StashAway has provided individual investors with a chance to put money into some of the best exchange-traded funds, or ETFs for short.

An ETF is an index-tracking investment fund where shares of the investment fund can be traded on a stock exchange at the current market price throughout trading hours. Indices are composed of a basket of securities belonging to a specific asset class, such as stocks or bonds, in a particular market segment, including technology, energy, or property.

Establishing a portfolio of ETFs is an affordable way to invest, as the administrative costs of passively-managed ETFs generally have lower expenses and management fees when compared to general mutual funds, which are more active. The other standout benefit of ETFs is reduced risk through diversification: diversified portfolios spread out investment risk, enjoying higher returns by averaging out the fluctuations of a single stock.

Introducing StashAway’s Easy-To-Use Wealth Building Platform

The technology behind the platform allows anybody access to sophisticated investing as it strives to empower people to build long-term wealth by offering incredibly low fees, no minimum deposits and unlimited withdrawals. Residents of Thailand have in recent years been accelerating their investments overseas, and StashAway gives those who wish to invest in foreign markets a way to do so that is intelligent, and also incredibly easy.

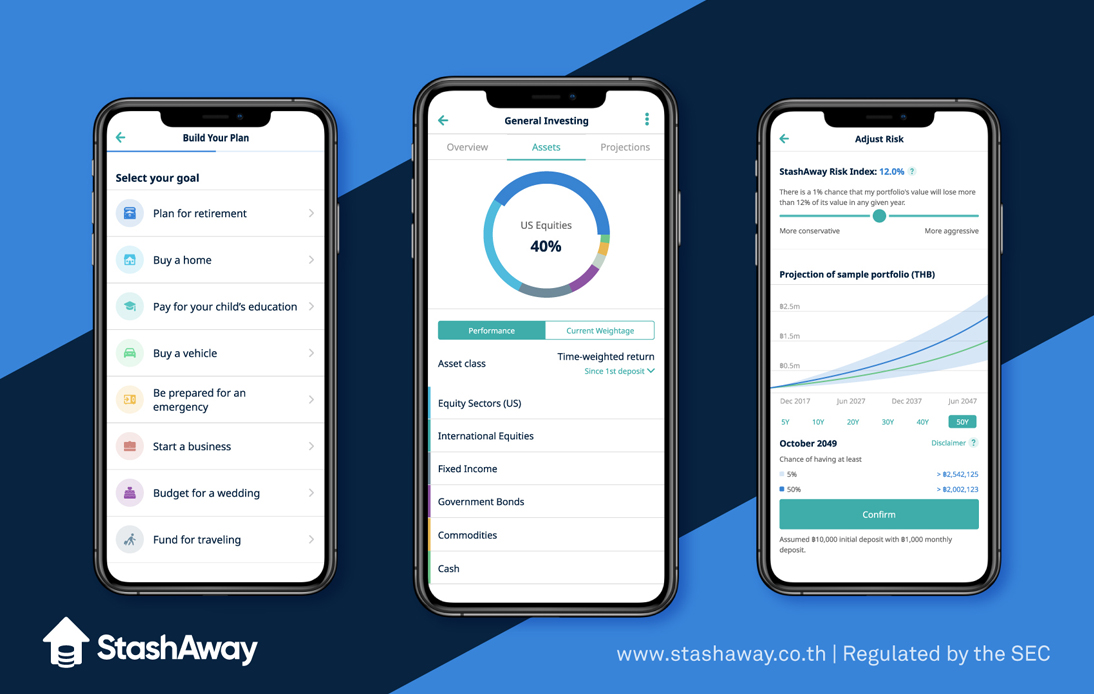

Available to download on the Apple App Store and Google Play Store, StashAway’s app enjoys 4.5 star ratings and features a well-designed, user-friendly interface that even a beginner investor can confidently use. At the click of a button, you can adjust your risk preferences or financial goals, check on your portfolios, get market updates, or further your knowledge with StashAway Academy’s step-by-step, interactive courses.

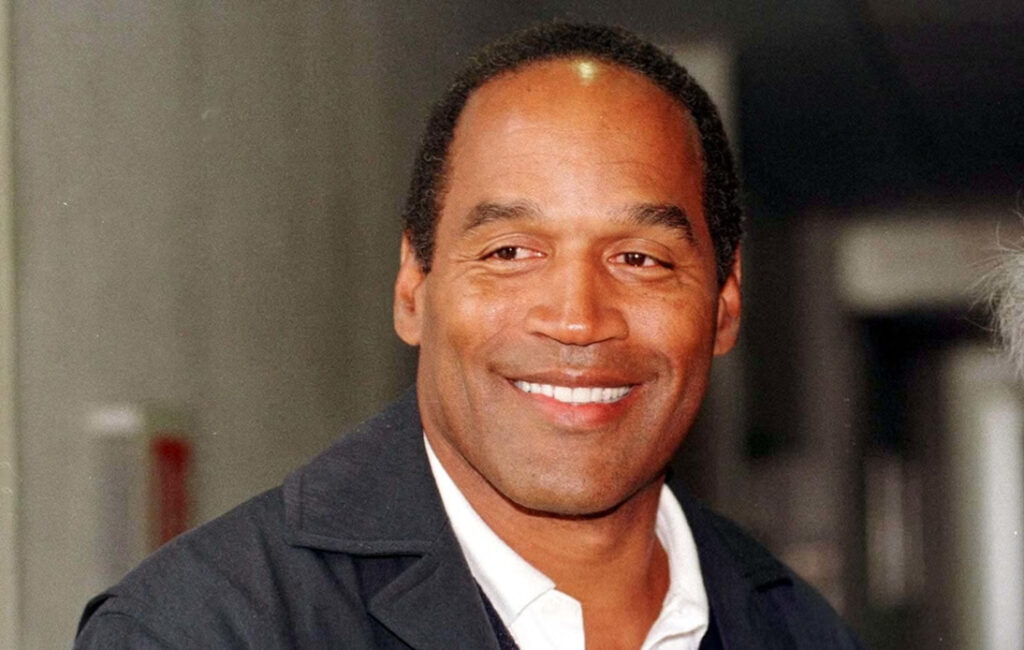

StashAway is regulated by Thailand’s SEC (Securities and Exchange Commission), who carries out the vital role of supervising the country’s capital markets. Tim Niranvichaiya, CFA, StashAway Asset Management (Thailand) Managing Director, is seen below and leads the company as they work towards helping clients grow their wealth.

StashAway has their headquarters in Singapore and has operating licenses in Malaysia, Hong Kong, MENA regions, and Thailand. The company is in charge of managing more than US$1 billion of assets and have the backing of well-known venture capital groups, including Sequoia Capital India, Eight Roads Ventures, and Square Peg.

If you are not sure exactly what you are saving for, then do consider a General Investing portfolio as your money will be put to work ready for when you want it, all you have to do is choose one of twelve levels of risk, then allow StashAway to do the rest. Goal-based, personalized portfolios are ideal to save an exact amount on a set date, helping you to achieve important goals such as buying a house or paying for your children’s tuition.

Your personalized portfolio, tapping into StashAway’s comprehensive list of global, high-quality ETFs, is created and managed with the advanced investment framework ERAA™ (Economic Regime-based Asset Allocation). It has been uniquely designed to limit and control the risk exposure of customers by adapting to fluctuating economic factors.

Discover the World of ETFs and Begin Your Investment Journey

One of the highlights of using the platform is that customers are not subject to the large, hidden costs which are often associated with other investment vehicles, by charging low management fees of just 0.2 to 0.8% of your total assets. The transparent fee structure is much lower than usual and StashAway do not apply any front-end or exit fees.

The company gives unbiased advice that is always in your best interest and there are no rebates from other fund managers within the system: they receive no commission from any parties, with no hidden charges and one single management expense.

To learn more about StashAway Thailand, you may visit: www.stashaway.co.th with the apps available at: Apple App Store or Google Play Store for download.