Warren Buffett’s corporation has sold its final shares in TSMC, the world’s preeminent chip manufacturer, subsequent to the “Oracle of Omaha” issuing warnings about its headquarters in Taiwan.

A report submitted on Monday unveiled that Berkshire Hathaway (BRKA) confirmed its termination of stake in Taiwan Semiconductor Manufacturing Company (TSM) at the end of Q1.

In the previous weeks, Buffett frequently expressed concerns about Taiwan’s future, the self governed democratic island that serves as TSMC’s base.

The Communist regime of China has long claimed Taiwan as a portion of its domain, despite never having ruled over it.

This decision marks the final withdrawal from TSMC by one of the globally most observed investors, who had already been gradually reducing its stake in recent times.

During February, Berkshire announced that it had sold 86% of its TSMC shares, acquired for $4.1 billion just a few months earlier. This quick sale was unusual as Buffett is recognized for his long-term investment strategies.

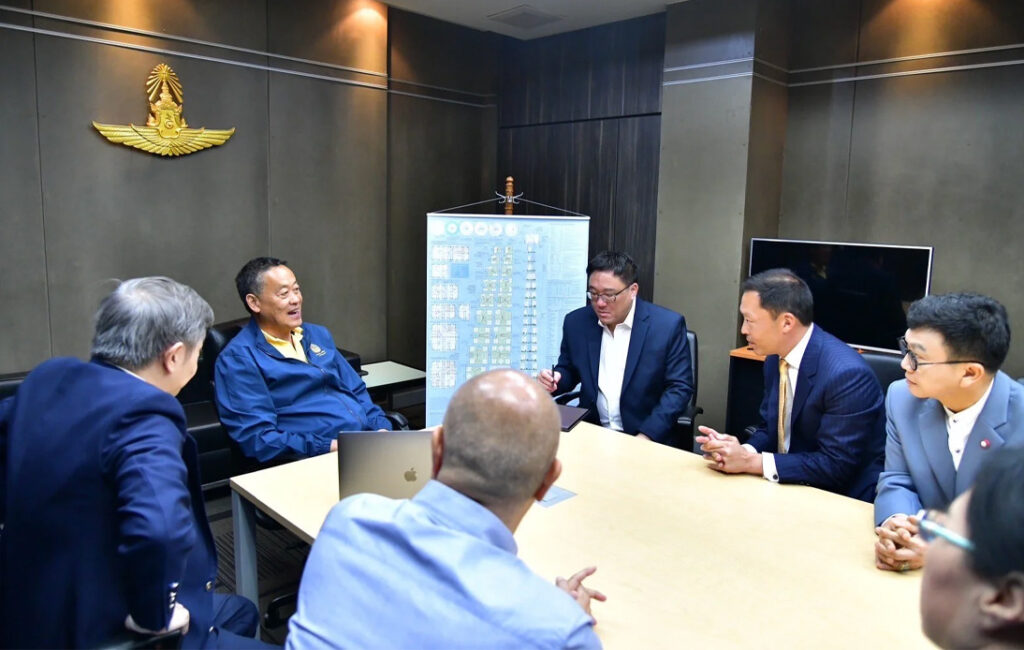

When questioned to justify his choice in an analyst meeting this month, the billionaire responded: “I don’t like its location, and I’ve reevaluated that.”

“I feel better about the capital that we’ve got deployed in Japan than in Taiwan,” the chairman of Berkshire Hathaway added. “I wish it weren’t sold, but I think that’s a reality.”

Despite selling the shares, Buffett praised TSMC as “one of the best-managed companies and [most] important companies in the world.”

“There’s no one in the chip industry that’s in their league, at least in my view,” he stated.

“Marvelous people and marvelous competitive position and everything, [but] I’d rather find it in the United States.”

Buffett disclosed that his reassessment of the company occurred in “light of certain things that were going on.” He had previously identified geopolitical strains as an issue.

TSMC chooses to refrain from commenting on Berkshire Hathaway’s divestment on Tuesday.

TSMC is treasured as a national asset in Taiwan, providing semiconductors to worldwide tech giants such as Apple (AAPL) and Qualcomm (QCOM).

The company manufactures the most cutting-edge semiconductors globally, parts crucial to the seamless operation of devices ranging from smartphones to washing machines.

As per Gartner, TSMC is the largest chip producer worldwide. It is also among the most valued publicly traded companies, with a market capitalization of 12.8 trillion New Taiwan Dollars (approximately $415.3 billion) as of Tuesday.

TSMC’s presence is believed to offer a compelling reason for the West to protect Taiwan against any aggressive takeover attempts by China.

The company’s value to the global economy, and to China, is so significant that it’s occasionally referred to as a component of a “silicon shield” against potential military invasions by Beijing.

While TSMC is broadening its global reach, including in the United States, it is also expanding its operations in Taiwan, intending to create over 6,000 jobs this year.

As Berkshire Hathaway declared its exits on Monday, other high-profile investors displayed confidence in the stock. Regulatory filings indicate that Macquarie has augmented its stake in TSMC, while Tiger Global has newly invested.

TSMC stock experienced a 2% rise on Tuesday in Taipei, while its US-listed shares saw a 0.5% dip in after-hours trading in New York.