The baht has shown a resurgence this week, trading at 36.08 against the dollar on Monday, accounting for a 1.4% recovery compared to the previous week and after a long-term vulnerability.

The currency of Southeast Asia’s second-largest economy weakened 10.3% against the US dollar during the first and second quarters of 2022. In addition, Russia’s invasion of Ukraine and Western sanctions on Vladimir Putin’s government impacted the global economy. , leaving most foreign currencies under the influence of the US dollar.

According to Kobsidthi Silpachai, head of Capital Markets Research at Kasikornbank (KBank), the supply shock added to the inflationary pressure. Consequently, the US central bank has tightened monetary policy and reduced the US dollar supply, causing the currency to rise relative to the Thai baht and others.

The United States Federal Reserve (Fed) has raised interest rates three times this year, leaving the reference rate between 2.25% and 2.50%.

The Fed has had 14 tightening cycles since World War II, with 11 ending in recession. They “are odds of 78%. This prompted the markets to have a change of heart,” Mr. Kobsidthi said, explaining that future markets’ expectations over the Fed Funds’ path decreased as a result.

“This was confirmed by the release of the US GDP data in the second quarter of this year, which contracted 0.9%, the second consecutive quarter. It is a technical recession,” he added.

Mr. Kobsidthi also said that decreasing expectations over the Fed Funds led to changes in expectations for the US Dollar Index (DXY), causing a mean reversion in trend.

Wei-Liang Chang, a foreign exchange and credit strategist at DBS in Singapore, also said the Fed’s rate hike has had positive effects on the baht.

The Thai currency has rallied against the US dollar as it has weakened as the market prices in smaller rate hikes for the US’s weakening growth, he added.

Singapore and the Philippines experienced similar situations and were forced to take special measures to control the currency.

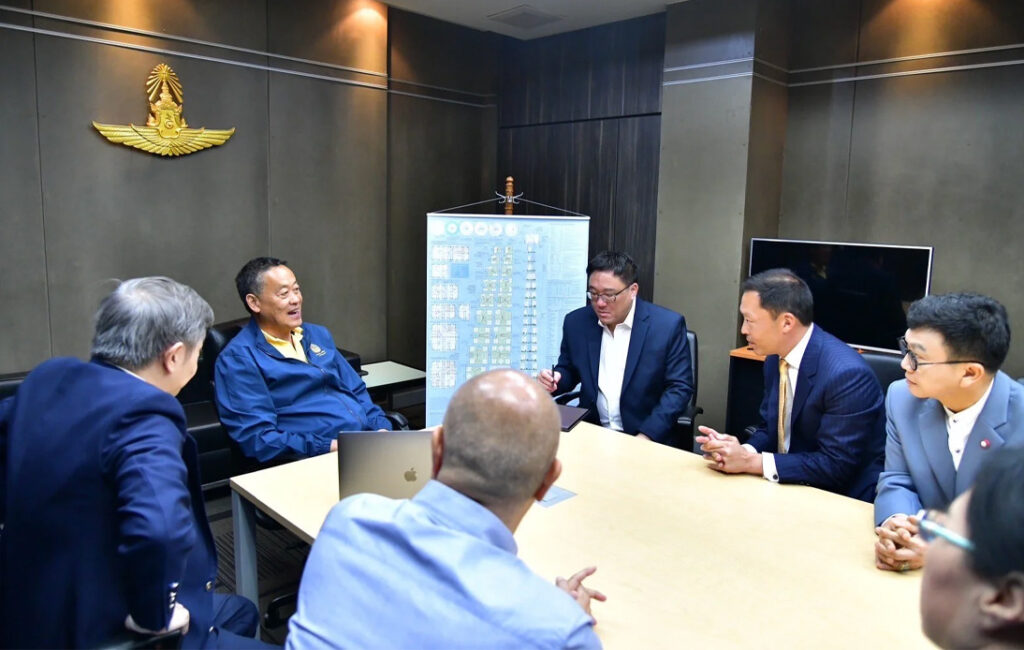

However, Bank of Thailand Governor Sethaput Suthiwartnarueput said the kingdom should not follow in the footsteps of neighboring countries as its main financial institution agreed to let the baht move according to market forces.

The Thai central bank will only take action if there is excessive volatility, Mr. Sethaput added.