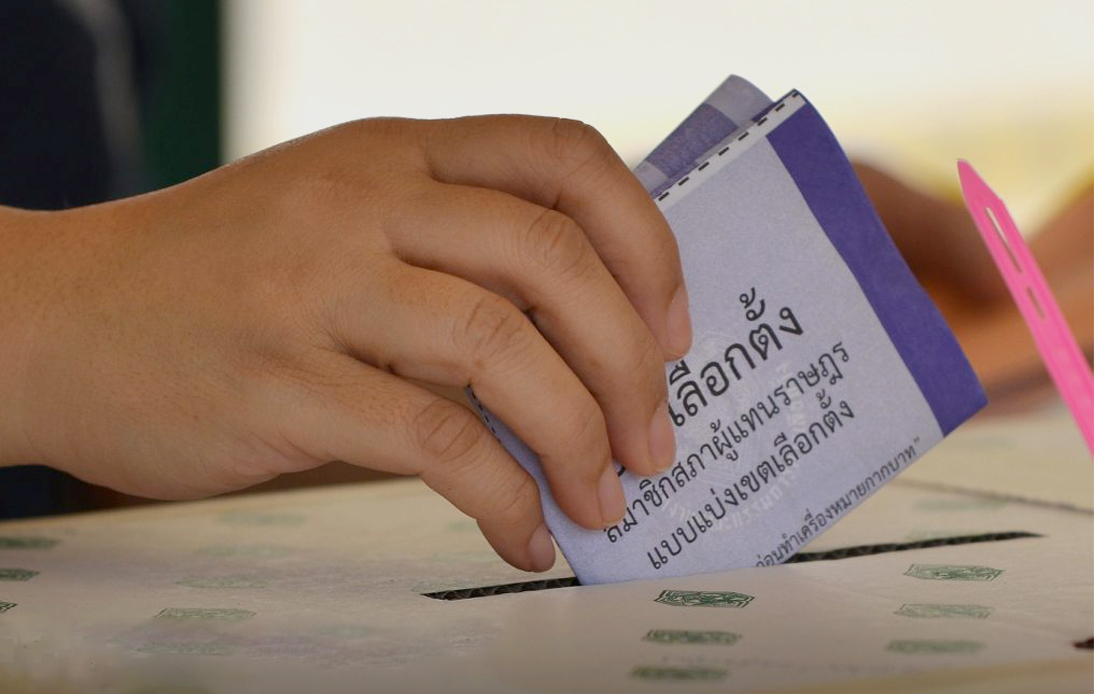

Analysts predict that the next general election will increase spending, resulting in 60 to 70 billion of baht to flow through the Thai economy, with a boost for the Thai stock market a week before and a month after the vote.

Yuanta Securities has reported, based on a statement released by the Office of the Election Commission (EC) of Thailand, that the Stock Exchange of Thailand (SET) is anticipated to recover around the time of the election, forecast to take place on Sunday, May 7th.

A report from the brokerage on Wednesday stated: “We anticipate money circulation in the Thai economy to reach a high two months before the election, accounting for 0.3-0.4% of the country’s GDP.” The Election Commission’s 5.9 billion baht election budget represents an increase of 40%.

The report stated that a greater number of constituencies – an increase from 350 districts to 400 – was the reason for the spike in the EC’s electoral budget, 40% more than the last election that took place in 2019.

According to Yuanta Securities, “one of the elements that encourages spending and helps minimise the downside to GDP during the government’s transitional period is the higher amount of money in economic circulation.”

Banking, retail, real estate, food and beverage, and construction are some of the Thai industries anticipated to profit from the next election, as a result of money circulating quicker in the country’s economy.

Prime Minister Prayut Chan-o-cha declared his intention to dissolve parliament next month on Tuesday, an announcement that saw the SET Index increase by 0.66% to settle at 1,668.63.

Investors based outside of Thailand were net sellers of a figure calculated to be in excess of 4.2 billion baht.

The retail and food industries are projected to profit from the expected increase in consumer spending, according to the research division of Globlex Securities, which noted that the premier’s remarks on Tuesday increased stock prices in both industries.

Although foreign investors may once again become net buyers after the election result is confirmed, Yuanta Securities predicts that domestic investors will continue to be net buyers prior to the election. 11 billion baht is the anticipated average volume forecast for the two months leading up to the election.

Based on data gathered during prior elections, the brokerage said that the Thai stock exchange has a propensity to perform better than other markets in MSCI Asia apart from Japan.

“The SET Index is likely to surge 2.1% during the two weeks before the election and 5.1% one month after, potentially reaching 1,750-1,800 basis points in the next three months,” said Yuanta Securities in a report.

According to a prediction by Yuanta Securities, “The SET Index is likely to surge 2.1% during the two weeks before the election and 5.1% one month after, potentially reaching 1,750-1,800 basis points in the next three months.”

Based on data from 2001 to 2019, Asia Plus Securities forecast that the election rally won’t continue very long and noted that the SET Index typically generates positive returns for the three months before each election.

The brokerage assessed that returns during those times were on average 3.9%.