On Friday, Thailand’s regulator warned Syn Mun Kong Insurance (SMK) that it could face legal action or fines if it continues with its plan to terminate Covid-19 insurance contracts with lump-sum payments.

The Office of the Insurance Commission (OIC) threatened SMK to block terminations if it does not strictly comply with all the conditions established in the contracts.

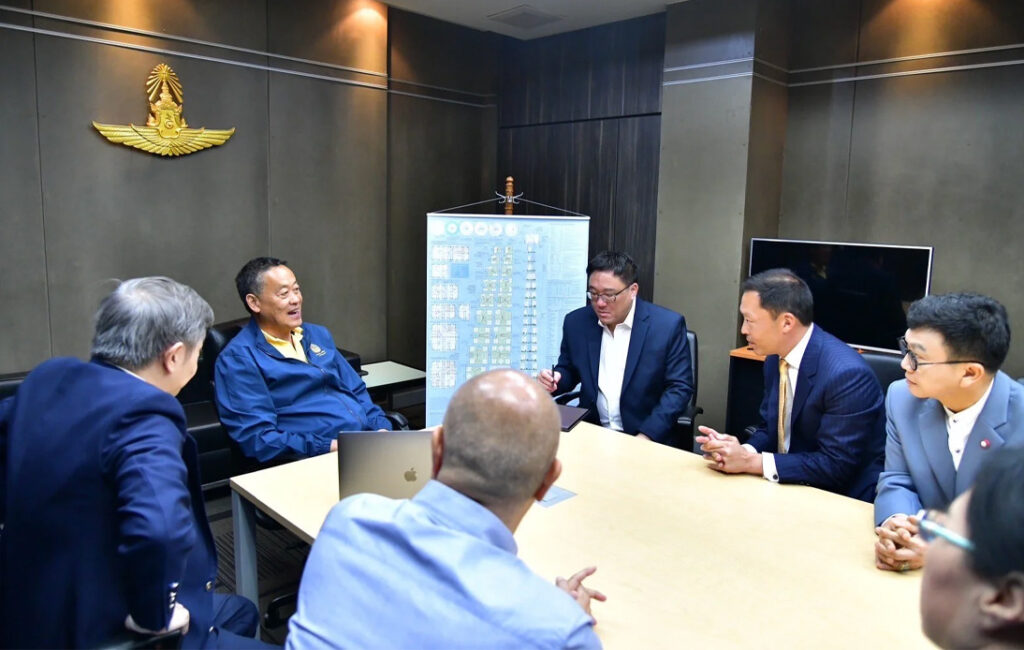

OIC secretary-general Suthiphon Thaveechaiyagarn said they had been in talks with SMK over its plan.

“If it does not change its decision, we can exercise the registrar authority to require the company to honor the condition of the original insurance contracts,” he added.

“The company may be charged ends as well,” he went on.

The regulator’s warning followed a statement from SMK saying it was ending Covid-19 lump sum insurance claims.

Bangkok Insurance, Dhipaya Insurance, Muang Thai Insurance and other insurers publicly said they had no intention to terminate their contracts.

The companies assured their clients that they were still protected by their original contract.

Viriyah Insurance announced Friday afternoon that it would not renew all Covid-19 insurance policies.

However, it backtracked an hour later, following a backlash, and said it would keep the original contracts for existing customers with new insurance programs for new customers.

Insurance providers have struggled to determine a price for the risk posed by the pandemic uncertainty.

They have also faced growing complaints and general inquiries as hospitalizations and deaths from Covid-19 increase.

Besides, insurers had been not only covering claims from people who legitimately caught the virus but also from people who got intentionally infected to receive insurance money, media reported.

Early this month, the Thai General Insurance Association warned the public about the fraud charges they could face if they get intentionally infected for an insurance claim.

On Friday, SMK issued a statement saying it can “exercise the right to terminate the lump sum Covid 2-in-1 insurance”.

The company cited the contract’s condition, effective 30 days from the date the letter is received.

SMK would refund the premiums deducted for the protection period promotion rate no more than 15 days after the termination’s effective date.

SMK’s capital adequacy ratio reportedly stood at 443% ending the first quarter, representing a drop from 458% in late 2020.

An industry source who asked not to be named said the company had the second-largest market share for Covid-19 insurance protection.

Meanwhile, the Thai Life Assurance Association asked its members to respect the original contracts, arguing that insurers must correctly calculate the risk involved in selling policies.